Introduction

Investing is a way to grow your money, but for some people, it’s important to do so in a way that aligns with their religious beliefs. This is where the concept of Sharia-compliant stocks and indices comes into play. In India, just like in other parts of the world, some investors prefer to put their money into companies that follow Islamic principles. Let’s break down what this means and how it works.

What are Sharia-Compliant Stocks and Indices ?

Sharia-compliant stocks and indices are a special type of investment option for people who follow the principles of Islam. Islam has certain rules about what is allowed and what is not allowed in various aspects of life, including finances. These rules are based on the teachings of the Quran and the sayings of Prophet Muhammad (pbuh).

When it comes to investing, Sharia-compliant stocks and indices are chosen based on specific guidelines. These guidelines avoid companies that deal with activities like alcohol, gambling, pork, and interest-based financial transactions. These activities are considered non-compliant with Islamic ethics. So, investors who want to invest in a way that’s in line with their beliefs can choose these stocks and indices.

How Do Sharia-Compliant Investments Work ?

Imagine you want to invest your money, but you also want to make sure that your investments don’t support things that go against your religious beliefs. Sharia-compliant investments help you achieve this. Companies that are included in Sharia-compliant indices are carefully selected to ensure they don’t engage in activities that are considered unethical in Islam.

For example, a company that makes alcohol or runs a casino would likely not be included in a Sharia-compliant index. Instead, companies involved in sectors like technology, healthcare, and manufacturing are usually considered more in line with Islamic values.

Sharia-Compliant Mutual Funds

One popular way to invest in Sharia-compliant stocks is through mutual funds. Mutual funds are like a pool of money collected from many investors. Professional fund managers then use this money to buy a collection of stocks that meet the Sharia guidelines. This way, you can invest in a diversified portfolio of companies while still adhering to your beliefs.

Nifty offer to Investors

Nifty presenst three options to choose from :

Nifty Shariah 25

Nifty Shariah 50

Nifty Shariah 500

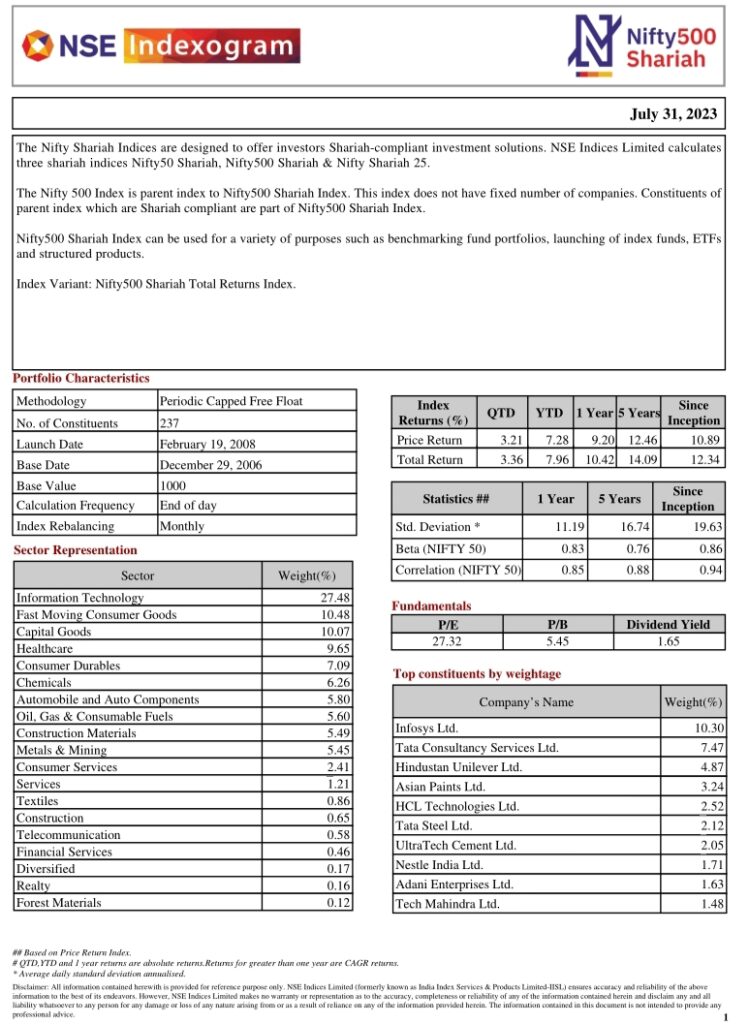

Every index has its own set of stocks, and the number of stocks increases with the size of the index.Here we present how the factsheet for Nifty Shariah 25 looks.

source : nse official website https://niftyindices.com/indices/equity/thematic-indices/nifty-shariah-25

Benefits and Considerations

The main benefit of investing in Sharia-compliant stocks and indices is that it allows you to grow your wealth in a way that aligns with your values. It’s a way to balance your financial goals with your ethical beliefs. However, it’s important to note that just like any other investment, there are risks involved. The value of stocks can go up and down, and there’s no guaranteed profit.

Conclusion

Sharia-compliant stocks and indices provide a unique investment option for those who want to grow their money while following Islamic principles. In India, these investments allow people to support companies that are ethically aligned with their beliefs. Whether you’re investing in individual stocks or through mutual funds, it’s essential to research and understand the companies you’re investing in. Like any investment decision, it’s important to make choices that suit your financial goals and your values.