Introduction

The Indian share market, often referred to as the Indian stock market, is a dynamic and complex financial ecosystem that plays a pivotal role in the country’s economy. With a rich history dating back to the early 19th century, the Indian share market has evolved into one of the world’s largest and fastest-growing stock markets. In this article, we will explore the key aspects of the Indian share market, its components, regulatory framework, and strategies for investors.

The Components of the Indian Share Market

The Indian share market comprises two major stock exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These exchanges provide a platform for buying and selling shares of publicly listed companies. While the BSE is the oldest stock exchange in Asia, the NSE is known for its advanced electronic trading platform.

The market is divided into two segments:

The primary market and the secondary market. The primary market is where companies issue new shares to raise capital through Initial Public Offerings (IPOs). In contrast, the secondary market is where investors trade existing shares among themselves.

Regulatory Framework

The Securities and Exchange Board of India (SEBI) is the primary regulatory authority overseeing the Indian share market. SEBI’s role is to protect the interests of investors, promote fair and transparent trading practices, and ensure the smooth functioning of the market. SEBI formulates regulations and guidelines that govern various aspects of the market, including listing requirements, insider trading, and corporate governance.

Investor Participation

Indian share market attracts a diverse range of participants, including retail investors, institutional investors, foreign investors, and traders. Retail investors are individuals who invest in shares for wealth creation or income generation. Institutional investors, on the other hand, include mutual funds, insurance companies, and pension funds that manage large pools of capital. Foreign institutional investors (FIIs) play a crucial role in the Indian market by investing in Indian stocks and debt instruments.

Investment Strategies

- Investing in the Indian share market can be rewarding but also comes with risks. Here are some common investment strategies:

- Long-term Investing: This strategy involves buying shares of fundamentally strong companies and holding them for an extended period. The aim is to benefit from capital appreciation over time.

- Day Trading: Day traders buy and sell shares within the same trading day to profit from short-term price fluctuations. It requires significant market knowledge and discipline.

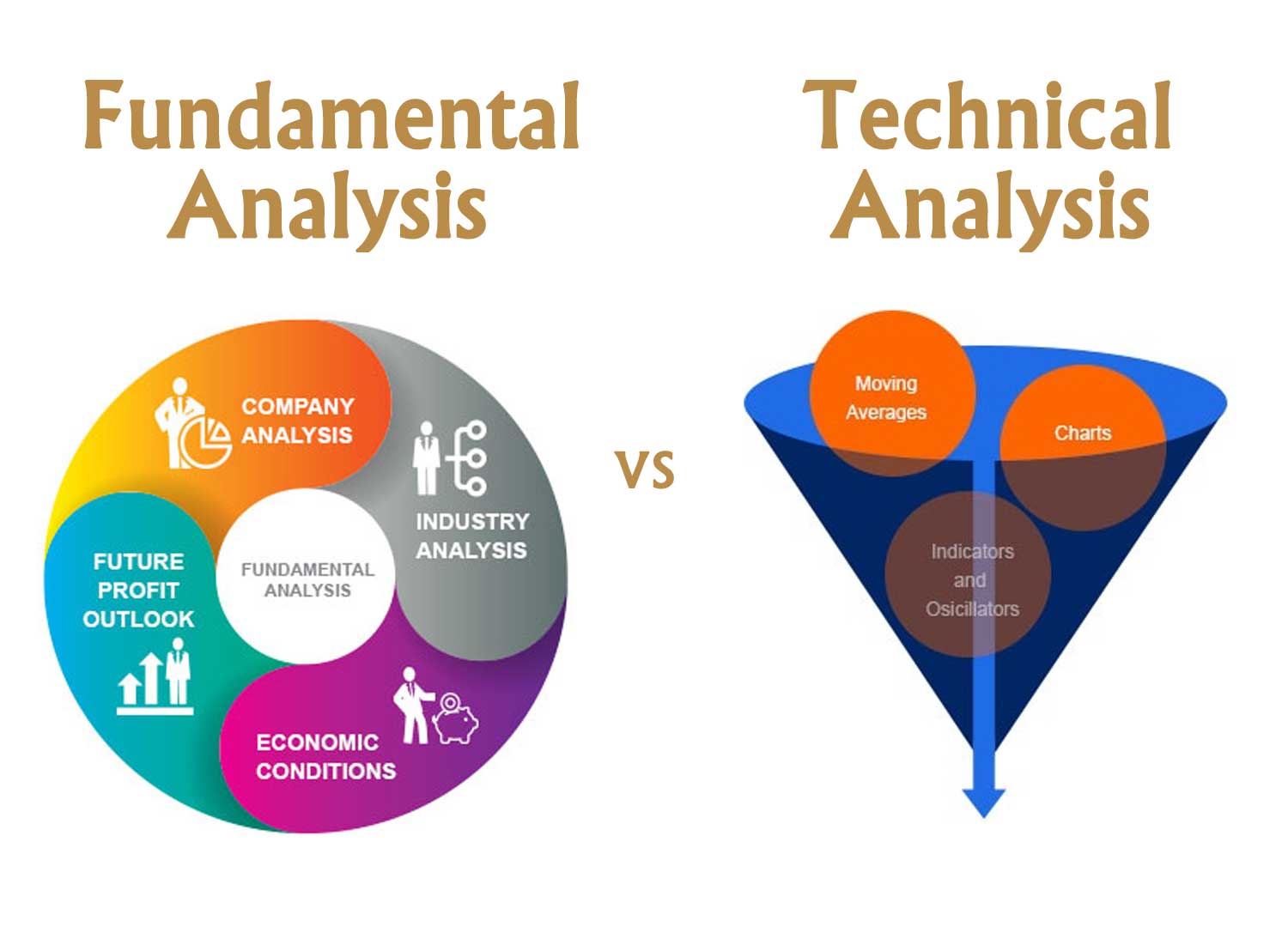

- Value Investing: Value investors look for undervalued stocks trading below their intrinsic value. They believe that the market will eventually recognize the true worth of these stocks.

- Diversification: Spreading investments across different sectors and asset classes can help manage risk. Mutual funds and Exchange-Traded Funds (ETFs) provide diversification options.

- Technical Analysis: Traders use technical analysis to study price charts and indicators to predict future price movements. It’s a method that requires skill and analysis.

Conclusion

The Indian share market, with its historical significance and robust regulatory framework, offers a plethora of opportunities for investors. However, it’s essential to approach the market with caution, conduct thorough research, and consider one’s risk tolerance and investment goals. Whether you’re a seasoned investor or a newcomer, understanding the dynamics of the Indian share market is the key to making informed investment decisions and navigating the ever-evolving financial landscape