There are various ways to analyse stocks and companies. The most famous ones are fundamental and technical analysis, but there are more. We will explain each of them briefly here.

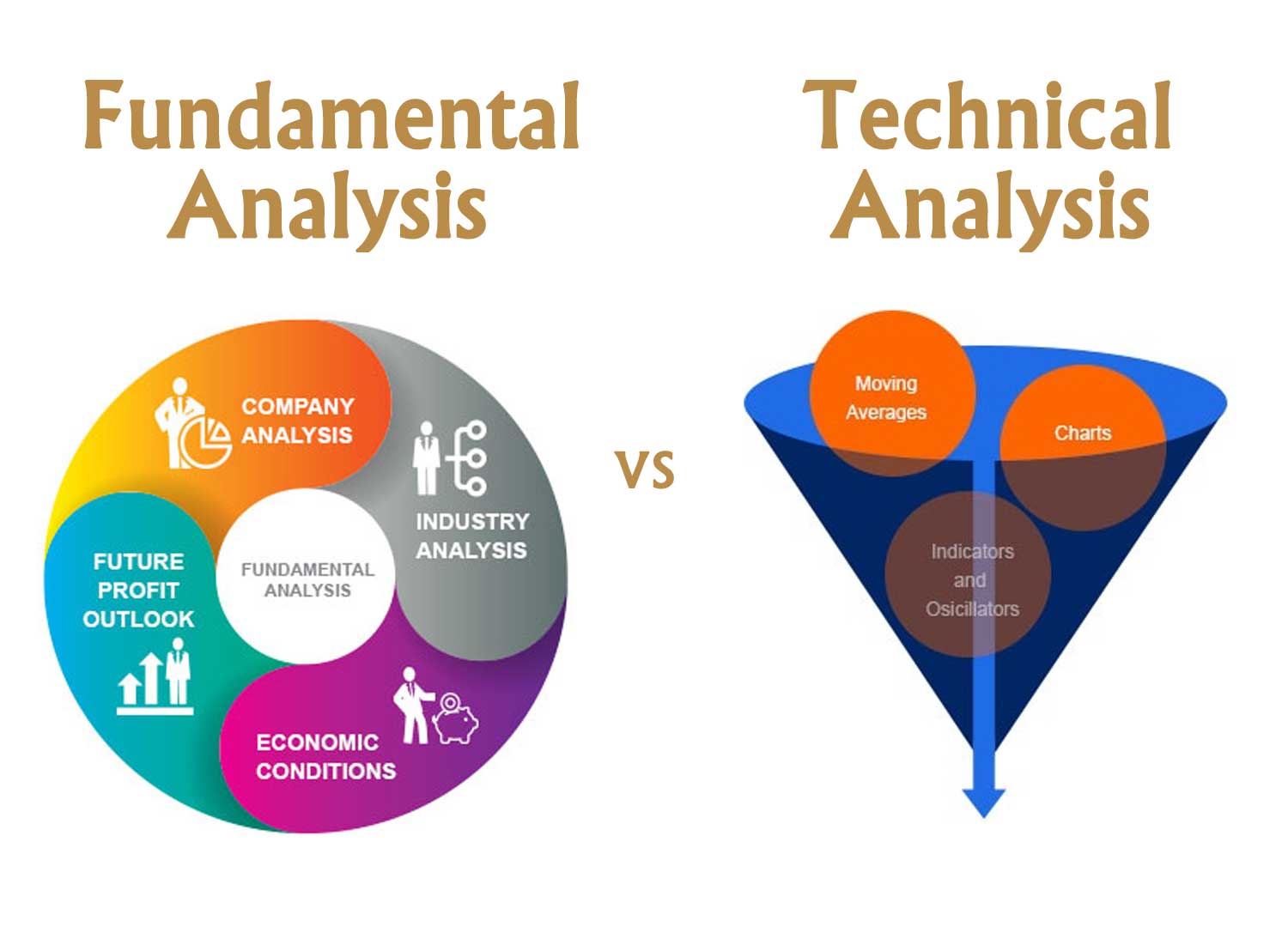

Fundamental Analysis

Fundamental analysis involves assessing the intrinsic value of a stock by analyzing various factors related to the underlying company’s financial health, industry position, and overall economic conditions. Key methods of fundamental analysis include:

1.Financial Statement Analysis

Examining the company’s financial statements, such as balance sheets, income statements, and cash flow statements, to evaluate its financial performance, profitability, and liquidity.

2.Ratio Analysis

Calculating and interpreting financial ratios, such as price-to-earnings ratio (P/E), earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio (D/E), to assess the company’s financial health and compare it with industry peers.

3.Industry and Market Analysis

Evaluating the company’s position within its industry, analyzing market trends, and considering factors such as competition, market share, and potential growth opportunities.

4.Qualitative Factors

Considering non-financial aspects, such as management team, corporate governance, competitive advantages, and future prospects, that may impact the company’s performance.

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns, trends, and signals that can help predict future stock price movements. Key methods of technical analysis include:

1.Chart Patterns

Analyzing price charts to identify patterns, such as support and resistance levels, trend lines, head and shoulders, and triangles, which may indicate potential price movements.

2.Indicators

Using mathematical calculations applied to price and volume data, such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence), to generate signals about buying or selling opportunities.

3.Volume Analysis

Examining trading volume to understand the level of market interest and confirm price trends or potential reversals.

4.Trend Analysis

Identifying and analyzing the direction and strength of price trends, such as uptrends, downtrends, or sideways movements.

Brace yourself for a thrilling journey as we explore these concepts in greater detail.

To be continued….