In the vast realm of stock trading, there exists a treasure trove of knowledge, often inaccessible to the everyday retail trader. While some YouTubers and brokerage firms offer fragments of this wisdom, the majority of retail traders remain unaware of its existence. The insights shared here aim to provide a fresh perspective and alternative approach to navigating the complex world of the stock market. However, it’s crucial to remember that knowledge alone doesn’t suffice; it’s the patient accumulation of wisdom that truly matters. Before you embark on your trading journey, take a moment to absorb this educational content and resist the urge to act impulsively. The information presented here is for educational purposes only, serving as your gateway to a deeper understanding of the financial markets.

Introduction:

In the world of financial markets, big players, often institutional investors and hedge funds, wield significant influence. Monitoring their positions can provide valuable insights for retail traders and investors. Two essential sources of information for verifying the positions of these big players are options data and futures roll-over data. In this article, we will delve into how these sources are used for position verification.

Understanding Options Data:

Options data includes information about the trading of options contracts, which grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified expiration date. Here’s how options data can be used:

Open Interest:

Open interest refers to the total number of outstanding options contracts for a particular strike price and expiration date. A surge in open interest at a specific strike price can indicate substantial institutional interest in that price level, suggesting a significant position.

Volume Analysis:

Monitoring the trading volume of options contracts can reveal unusual activity. A sudden spike in volume, especially in out-of-the-money or deep in-the-money options, may indicate the presence of big players.

Implied Volatility:

Options pricing models calculate implied volatility, which reflects the market’s expectations of future price swings. An unusual increase in implied volatility might be linked to large institutional positions.

Large Block Trades:

Watching for large block trades in options can be a direct indicator of big players. These substantial trades often occur off the public market, making them less visible but more significant in size.

Understanding Futures Roll-Over Data:

Futures contracts obligate traders to buy or sell an underlying asset at a future date. Understanding how traders roll over futures contracts can provide insights into their positions:

Expiration and Rollover:

Traders who hold futures contracts must decide whether to let them expire, roll them over to the next contract period, or close their positions. Analysing the patterns of rollover can indicate the intentions of big players.

Delivery Intent:

Examining the delivery intent of futures contract holders can reveal their positions. If a trader is unwilling to take delivery, it may indicate a speculative position.

Trading Volume:

Similar to options, monitoring the trading volume of futures contracts can help identify unusual activity, especially when coupled with substantial price movements.

Time Spreads:

Big players often employ time spreads, simultaneously holding long and short positions in different contract months. Analysing these spreads can reveal their strategic intent.

Conclusion:

Options data and futures roll-over data are valuable resources for verifying the positions of big players in the financial markets. Retail traders and investors can gain insights into institutional activity by carefully analyzing open interest, volume, implied volatility, and large block trades in options data. Similarly, studying the behaviour of traders as they roll over futures contracts, their delivery intent, trading volume, and use of time spreads can shed light on their positions.

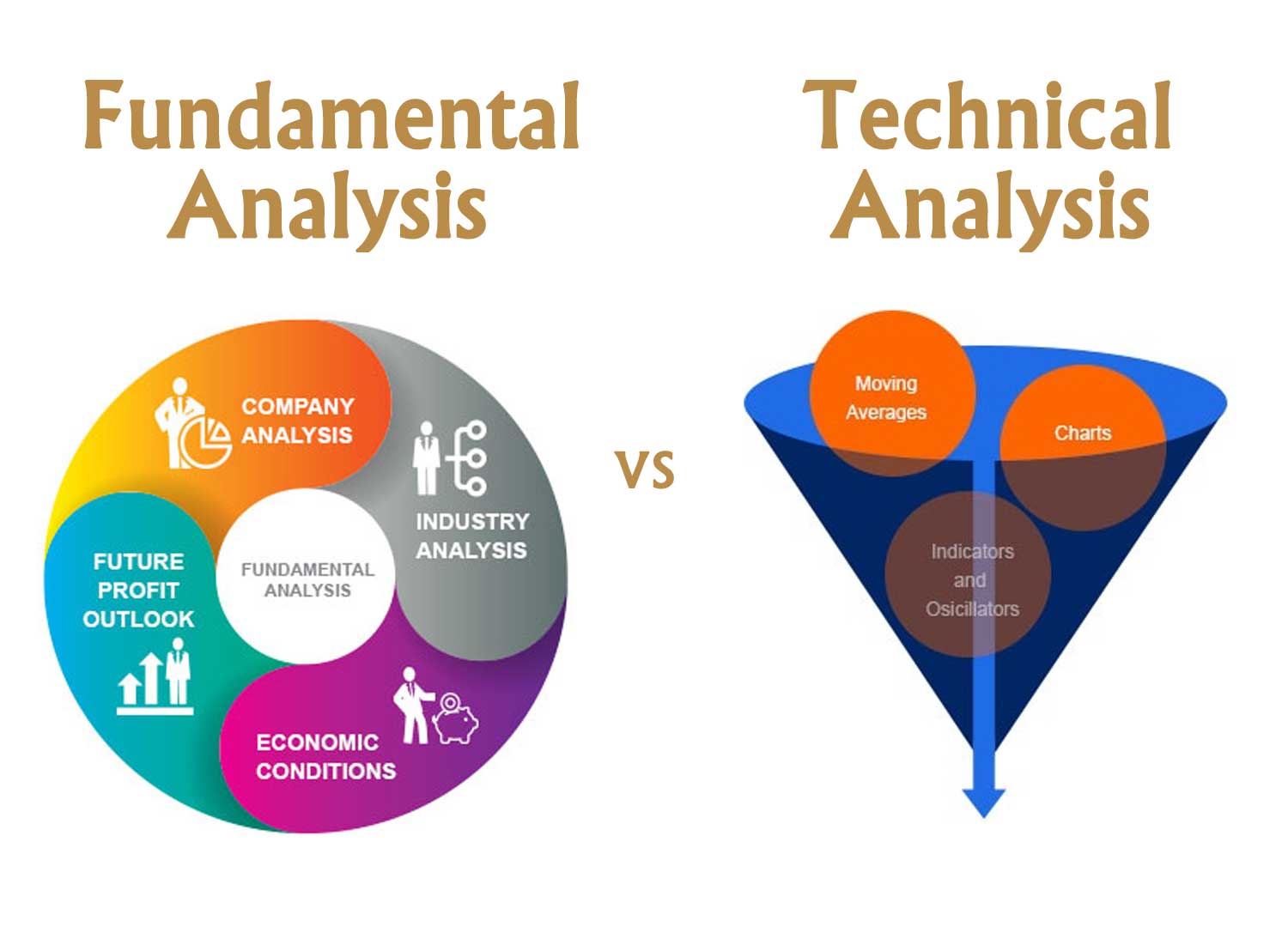

It’s important to remember that while these data sources provide valuable information, they are not fool proof. Big players are adept at concealing their intentions and strategies. Therefore, combining data analysis with other forms of research, such as fundamental analysis and market sentiment, can help create a more comprehensive understanding of market dynamics and the activities of institutional investors.

Disclaimer :

- Consult a financial adviser before investing.

- We provide general guidance, not personalized advice.

- Investments carry risks; past performance doesn’t guarantee future results.

- Compliance with legal and tax regulations is your responsibility.

- Please read our policy and guidelines for further information.